Directors and Officers Liability Insurance

Residentsline understands that as a Director or Officer of a Residents’ Management Company, Residents Association or Right to Manage Company you have many legal responsibilities and could be personally liable for decisions made or actions taken whilst working in your position as a Director or Officer.

What is Management Liability Insurance?

Management Liability Insurance includes both Directors and Officers Liability Insurance and Corporate Liability Insurance in one policy wording.

Management Liability protects Directors and Officers AND your Company for claims made against them for wrongful acts committed solely by reason of their acting as a director or officer of a company.

Policy cover includes the cost of defence, and in some cases the amount of awards and damages, as a result of claims and prosecutions made in a wide range of situations.

Get a quote and be covered in 10 minutes by following these simple steps

Make sure you have this key information to hand

Why You Need Cover?

Management Liability Insurance protects past and present Directors’ and Officers’ of your Company. The Directors and Officers Liability Insurance section include cover against the cost of potential compensation claims against any alleged wrongful acts.

Management Liability Insurance protects your Residents’ Management Company, Residents’ Association or Right to Manage Company against the financial consequences of potential claims. The Corporate Liability Insurance section includes the cost of defence, as well as the amount of awards and damages resulting from any claims made against the Company.

Management Liability Insurance includes both Directors and Officers Liability Insurance and Corporate Liability Insurance in one Policy and for one price.

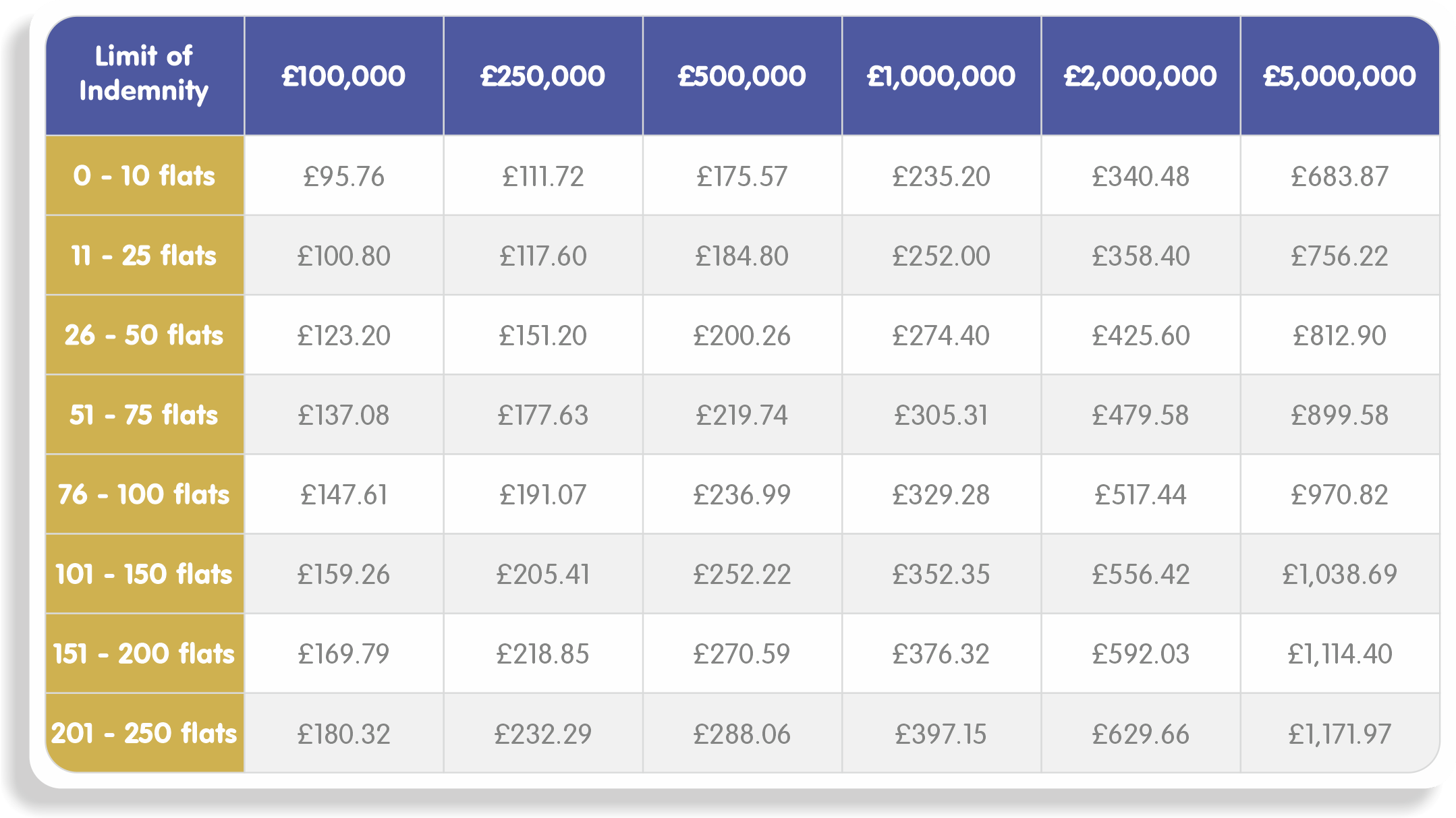

Our premiums start from only £95. It only takes a few minutes to get a quote by clicking here. If you prefer to talk to us, please call 0800 281235 and you could be on cover today.